Looking for more money inspiration?

That's where I come in!

The blog is dedicated to timely nuggets of money, business and life wisdom. I write all posts personally with the intention of helping you step into your full financial power and potential.

The simplest way to increase your income

and your profitability...

is to raise your prices.

The simplest way to raise your prices.

Make a decision to raise your prices.

Yep, pretty simple....

|

|

|

Do you like checking off a To-Do List like I do?

When it comes to creating an abundant financial container (aka foundation) for your business and life, it can help to have a checklist.

For e...

my reminder to you this week...

Directions:

Take one hand to your heart and one hand to your belly.

Breathe in and out with intention three times.

Say to yourself:

I am enough.

I do eno...

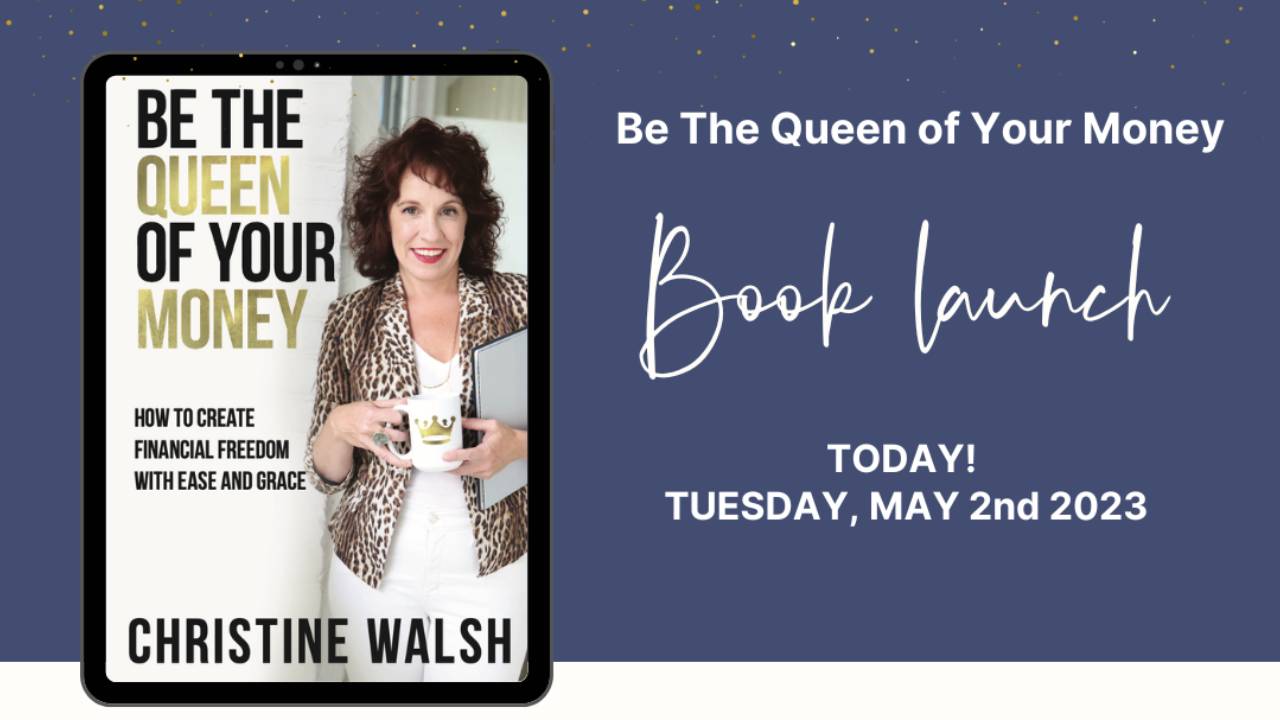

my book launches today! let's do this! 💃💃💃

calling all my money queens out there!

i am proud to present Be The Queen of Your Money: How to Create Financial Freedom with Ease and Gra...

The buck stops here.

For so long, I was taught, or internalized, "do more to get more."

And it created an underlying pressure to perform, compete, and keep working to attain my "happiness..." e...

Some days I question why I chose money coaching.

“Sheesh, Christine… Why did you pick this one?!?” LOL

I have to do my own continuous work with my money mindset, where my own money gremlin can hav...

Clarity means everything. But if you are like me, it is hard to get clear when there are so many possibilities out there.

How to create a financial vision for yourself, your business, your legacy

Ho...

JOIN THE LIST

Subscribe to my newsletter and get the latest tips and updates