Looking for more money inspiration?

That's where I come in!

The blog is dedicated to timely nuggets of money, business and life wisdom. I write all posts personally with the intention of helping you step into your full financial power and potential.

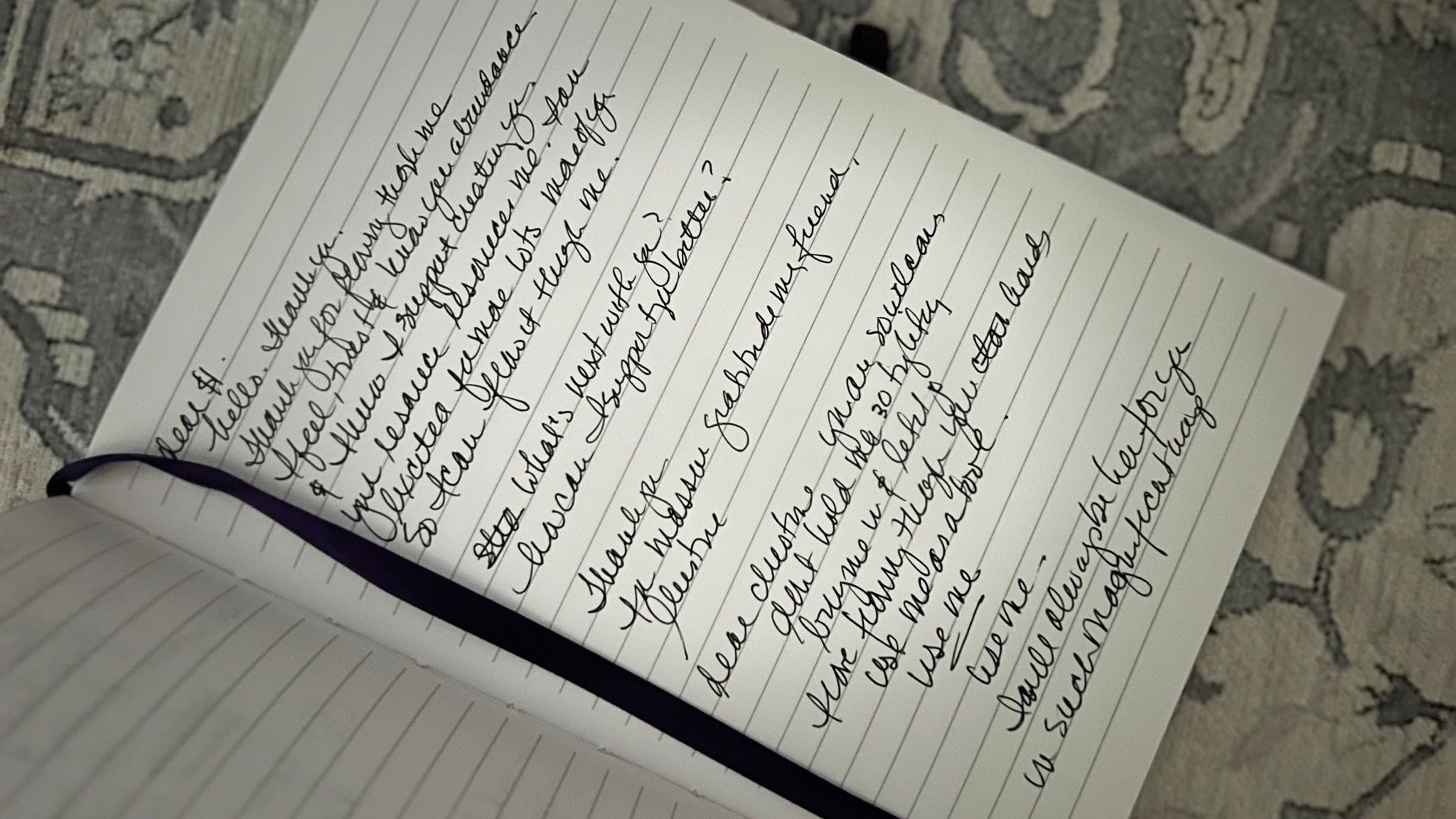

3.8.23

dear $.

hello, thank you.

Thank you for flowing through me

I feel, trust, and know your abundance.

& know i support creating you.

Your resource resources me. I am excited for more of yo...

Credit card debt.

Losing money on that stock recommendation.

Bought those gorjuss suede boots at full price that cost a month of groceries and now have a pit in your stomach.

Not putting away mone...

Remember what it was (is) like to fall in love?

- The anticipation of knowing the next time you would see each other

- The curiosity in getting to know each other

- The joy of experiencing things tog ...

After working with 100’s of people around money and business (including myself!)…

I wanted to share with you 26 things that I have seen indicate that a person will be an abundant and well-resourced e...

I’ll make this easy for you.

You get to decide if it is simple enough for you to do so…

I make suggestions, you make decisions.

There are several ways to create more money in your small busi...

What if all it took was 30 days?

30 days is not a lot of time and sometimes it feels like forever.

In 2022 I committed to 12 months of 30 days... of something (more to come down below).. to expand m...

I distinctly remember the session I had years ago with a client when she was having such a rough time around the idea of receiving money.

She had the number two money myth I see most often from ...

I am celebrating the best revenue month in my business this past month! Hootie hoo… 🎉

Celebrating the things I have put in place to receive to flow that “cash-ola” into my stewardship.

AND aft...

I am a money avoider.

The whole reason I started this coaching business to empower women to make money on their own terms was that I was a money avoider.

It is vulnerable to share that.

...

There is a saying out there that money loves speed. What that means is that the quicker you make decisions about your money (in business or in life) the quicker money will come to you. It is energetic...

JOIN THE LIST

Subscribe to my newsletter and get the latest tips and updates